How Financial Advisors Use Digital Marketing To Manage Their Sales Funnels

Sales funnels have quickly evolved as marketing has shifted away from traditional outbound marketing methods to inbound marketing tactics that rely on digital marketing. In particular, digital marketing has dramatically altered the management of sales funnels for financial advisors as well as other professionals. The effective use of digital marketing tools greatly facilitates the challenge of managing sales funnels with the utmost efficiency.

Plenty of financial advisors understandably do not know where to start in the quest to improve their management of digital sales funnels. So, a good starting point is to take a look at the best approaches for financial advisors to employ when using digital marketing to convert contacts into leads, prospects, and revenue-producing clients.

What is a Financial Advisor Sales Funnel?

Financial advisor sales funnels are best defined as the process used to convert contacts (they have names and email addresses) into clients who produce revenue for the financial advisory firm. The sales funnel moves the contact along the path to creating clients, starting as a contact all the way to the point the contact is converted into a revenue-producing client. Ideally, this endpoint of the sales funnel will generate satisfied clients who do not hesitate to recommend a financial advisory firm’s services to friends, family, and associates.

Financial advisor sales funnels are best defined as the process used to convert contacts (they have names and email addresses) into clients who produce revenue for the financial advisory firm. The sales funnel moves the contact along the path to creating clients, starting as a contact all the way to the point the contact is converted into a revenue-producing client. Ideally, this endpoint of the sales funnel will generate satisfied clients who do not hesitate to recommend a financial advisory firm’s services to friends, family, and associates.

Don’t be misled by what we say, moving prospects through the sales funnel is easier said than done. Thankfully, a menu of digital marketing tools is available to facilitate this process. However, many financial advisors are still unaware of the extent to which digital marketing tools can facilitate the nurturing process that moves investors from contacts to clients.

The ideal outcome of the financial advisor sales funnel is the complete conversion of a contact into a paying client in a timely manner. When digital marketing tools are used to their full potential, they are capable of converting website visitors into leads, prospects, and the final conversion - revenue-producing clients. Technology makes these steps simpler than you might think.

Read our blog articles:

RIA Marketing That Maximizes Lead Conversion Rates

Should Financial Advisors Offer 'Free Consultations' On Their Websites?

The Traditional Sales Funnel Versus the Financial Advisor Digital Marketing Sales Funnel

Prior to the rise of the internet and other tech advancements, the traditional sales funnel was in place to identify potential prospects and gradually guide them toward becoming clients. However, this traditional sales funnel did not rely on the Internet and the technology that automated the funnel process. This conventional sales funnel was primarily centered on identifying leads, interacting with those leads over the phone or face-to-face, and converting them into clients after one or several interactions.

Today’s effective sales funnels are primarily digital. Though some interactions still occur on the phone, through videoconferencing, and in-person, an increasing number of interactions occur on digital channels. In particular, the Internet has emerged as the most important innovation that impacts digital marketing sales funnels. Instead of attempting to identify prospects based on their industry or location, financial advisors and other professionals are using technology to identify quality leads that have a higher probability of needing their services.

As an example, financial advisor websites now have email signup forms that provide visitors with the opportunity to enter their contact information to receive email messages from financial advisors regarding services, industry news, and more. Furthermore, Google AdWords campaigns and search engine optimization (SEO) also help financial advisory firms identify those who are actively seeking advisors and financial information on the internet. These are very valuable investors that should be accelerated through the sales funnel because they have demonstrated a genuine interest in learning more about the benefits of services that are provided by financial advisors in their communities.

Learn more in our blog article: How Financial Advisors Use Email Marketing as Part of Their Sales Funnel Strategy

Why use a Financial Advisor Digital Marketing Sales Funnel?

Digital marketing sales funnels have proven effective at converting financial advisor firm contacts into revenue-producing clients. Such tech-driven sales funnels are efficient, effective, and affordable. Technology has advanced to the point that computers do much of the work on behalf of financial advisors. Take advantage of the inbound marketing tools detailed above, zero in on those most likely to convert into revenue-producing clients and you will find your financial advisory firm’s digital marketing sales funnel is your best source of new clients.

Digital marketing sales funnels have proven effective at converting financial advisor firm contacts into revenue-producing clients. Such tech-driven sales funnels are efficient, effective, and affordable. Technology has advanced to the point that computers do much of the work on behalf of financial advisors. Take advantage of the inbound marketing tools detailed above, zero in on those most likely to convert into revenue-producing clients and you will find your financial advisory firm’s digital marketing sales funnel is your best source of new clients.

Relying on such digital marketing tools is far cheaper and more efficient than paying teams of sales professionals who cold call prospects or attempt to communicate the firm’s value proposition through phone conversations, face-to-face interactions or mailing conventional marketing materials such as snail mail correspondence that is inefficient, slow, and expensive. The prudent use of a digital marketing sales funnel expedites the conversions of contacts into leads, leads into prospects, and prospects into clients. When contacts are nurtured the right way they become great sources of referrals to family, friends, and associates.

Continue to steer online traffic toward your sales funnel, be patient, and the bottom of the funnel will gradually fill with active prospects who become clients of your firm. In fact, there is a good chance that they become your best clients because they hired your firm for the right reasons.

Here's how you can Use Digital Marketing to Fine-Tune Your Financial Advisor Sales Funnel in 2021

The Components of Financial Advisor Digital Marketing Sales Funnels

It is best to think of the digital marketing sales funnel as a whole that has far greater value than the sum of its parts. For example, there are several distinct stages or components to the most successful financial advisor digital marketing sales funnels. Each stage of the digital marketing sales funnel requires a careful nurturing of prospects. The presentation of each component of the funnel along with the nuances of the language used in the attempt to convert prospects into clients really does matter a great deal. Though it is impossible to convert every single candidate who enters your financial advisory firm’s sales funnel into a paying client, it is reasonable to anticipate the funnel will convert a meaningful percentage of these individuals. What is meaningful? 25% at the low end and 50% at the high end.

The first stage of the most successful digital marketing sales funnels is setting goals and developing the strategy for achieving the goals. The goal is relatively straightforward, the strategy for achieving the goal not so much.

Once you have clearly defined the objective of your sales funnel, likely as a means of efficiently converting contacts into leads, leads into prospects, and prospects into revenue-producing clients, it is time to focus on steering traffic in the funnel itself.

This stage of the digital marketing sales funnel is referred to as the floodgates stage. As described above, there are myriad ways to steer traffic to your online sales funnel. As an example, implementing an email signup form on your website, establishing profiles on social media platforms, generating interest through SEO content, and launching an internet ad campaign that will help guide increasing amounts of traffic to your website - the start of your funnel.

Once you succeed in ramping up traffic to your website, social media, blog, and other components of your financial advisory firm’s online footprint, it is time to shift your attention to guiding that traffic from the funnel’s top step to its bottom step in an as efficient, timely manner as possible. However, moving such traffic from the top of the funnel to the bottom step that converts leads into clients is easier said than done. The manner in which your financial advisory firm’s online content is presented as well as the interactions between your firm and those prospects matter a great deal. In fact, the subtleties of this stage of the digital marketing sales funnel have the potential to alienate prospects or, alternatively, endear them to your firm.

The overall aim is to guide prospects toward the funnel’s end where they become revenue-producing clients. It should be noted that some future clients will not enter your digital marketing sales funnel at the very top. Some clients enter at other stages. However, the sales funnel conversion process does not change based on the entry point. The process remains consistent regardless of the specific stage at which prospects enter the digital marketing sales funnel.

Read our blog article: Financial Advisor Digital Marketing Content for Sales Funnels

Consider the Flywheel Approach

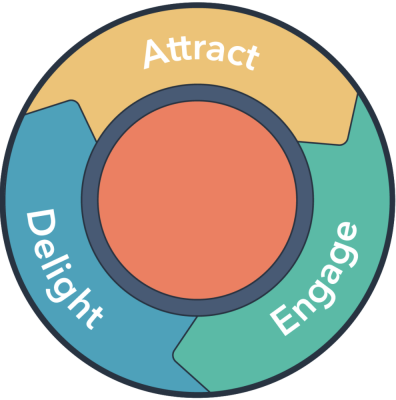

If you are intimidated by the prospect of establishing a digital marketing sales funnel, you are not alone. This is an important project worthy of your focus, marketing budget, and efforts to grow your firm. The HubSpot flywheel approach has emerged as an effective means of converting customers who are inclined to refer others to your financial advisory firm and help expand your revenue at a more rapid rate. HubSpot adapted the flywheel model to detail the momentum built when aligning your business with the overall aim of generating a rewarding customer experience that proves fulfilling to the point that it drives referrals on your behalf long after the initial investment of time, money, and effort.

Here’s how the flywheel works. Flywheels require momentum, typically created through investment in the effort to acquire clients and retain their business long beyond the first paid consultation or rendering of services. The challenge lies in amassing enough customers at the outset to satisfy them to the point that they build the flywheel’s momentum. Such continued momentum is generated through repeat consultations/payment for services as well as referrals to others in their professional, social, and family circles. After all, there is no sense spending your limited marketing dollars attempting to promote your financial advisory firm when your satisfied clients can do so on your behalf. In effect, the money you spend to build your flywheel’s momentum has the potential to multiply in an exponential manner after that initial investment is made.

Here’s how the flywheel works. Flywheels require momentum, typically created through investment in the effort to acquire clients and retain their business long beyond the first paid consultation or rendering of services. The challenge lies in amassing enough customers at the outset to satisfy them to the point that they build the flywheel’s momentum. Such continued momentum is generated through repeat consultations/payment for services as well as referrals to others in their professional, social, and family circles. After all, there is no sense spending your limited marketing dollars attempting to promote your financial advisory firm when your satisfied clients can do so on your behalf. In effect, the money you spend to build your flywheel’s momentum has the potential to multiply in an exponential manner after that initial investment is made.

The most important component of the flywheel approach is to keep it spinning without exhausting your marketing budget in the quest to add to your client base. When properly executed, the flywheel approach empowers satisfied clients to tout the value of your financial advisory firm’s services to other prospects, converting many of them in a cost-efficient manner and also leading to subsequent conversions.

The key is to continue to meet client expectations to the point that they feel motivated to recommend your financial advisory firm’s services to friends, colleagues, family, and others. The bottom line is it is cheaper to let your existing client base advertise through word-of-mouth on your behalf rather than paying lofty salaries and benefits to sales professionals to attempt to explain the merits of your services in a convincing manner. Keep in mind, people are more likely to value the words of their trusted peers, family, and colleagues rather than a professional salesperson who is driven by his or her need to make money.

Creating a flywheel requires an understanding of current clients. Financial advisors who understand their existing client base are more powerful than other influences such as conventional outbound advertising and even many forms of inbound marketing stand a much better chance of creating a successful flywheel. Even if your financial advisory firm has invested in both inbound and outbound marketing campaigns, you should seriously consider letting your clients do the work for you.

As an example, satisfied clients who post positive reviews of your financial advisory firm on the many different online review directories will encourage prospects to seriously consider your firm’s value proposition. In fact, nearly 85% of consumers trust web-based reviews to the same extent that they trust personal recommendations. Rack up those glowing customer testimonials, use cases, and references that put your satisfied clients on display and you won’t have to spend as much time or effort attempting to communicate the merits of your services.

Recognize the Power of Social Proof

Whether you take the flywheel approach or the digital marketing sales funnel approach, your

success will be partially dependent on whether your clients generate sufficient social proof. Social proof is the notion that people decide what they consider to be accurate and meaningful based on the opinions of others. As noted above, people largely trust reviews posted to online directories yet they are inherently suspicious of sales professionals as well as traditional outbound marketing materials. This means social media will prove essential to your financial advisory firm’s success.

Social media provides the opportunity for your exuberant clients to tout the merits of your services, “like” your page/posts on social media platforms, and steer fellow social media users in your firm’s direction. Exceed your current client base’s expectations and they really will be inspired to expound on your firm’s value offering with glowing reviews, comments, and other write-ups on social media, review directories, and other websites. This is the “converting content” your financial advisory firm needs to steer even more customers your way, guiding them through your sales funnel or building even more momentum for your flywheel to continue spinning.

Eliminate Sources of Friction

Friction is the enemy in the quest to guide prospects through your digital marketing sales funnel or build momentum for your flywheel. In short, it is in your interest to remove obstacles as well as other inconveniences during the sales process. Zero in on potential sources of friction that make it more challenging to convert prospects into paying clients, brainstorm ways to minimize or eliminate those sources of friction and it really will be that much easier to steer more people through your sales funnel or generate momentum so your flywheel can spin exactly as you envision.

Friction is the enemy in the quest to guide prospects through your digital marketing sales funnel or build momentum for your flywheel. In short, it is in your interest to remove obstacles as well as other inconveniences during the sales process. Zero in on potential sources of friction that make it more challenging to convert prospects into paying clients, brainstorm ways to minimize or eliminate those sources of friction and it really will be that much easier to steer more people through your sales funnel or generate momentum so your flywheel can spin exactly as you envision.

The moral of this story is to make it easy for your target clients to learn more about your financial advisory firm, understand your unique value offering, schedule an appointment and tout your firm’s merits to others. Succeed in this feat and you will have set the stage for an endless number of prospective clients to truly understand your firm’s value proposition and ultimately move through the sales funnel, becoming loyal clients who recommend your firm to other professionals, friends, family, and others.

Exhaust All Online Avenues to Fill Your Sales Funnel

The most successful financial advisors use digital marketing to manage sales funnels in all sorts of creative ways. If you were to exclusively focus on only one component of inbound marketing such as SEO, social media, paid online ads, or email signups, you would certainly make some headway in your quest to load up your sales funnel. However, such a narrow focus would not lead to results that meet your expectations. Seize the opportunity to fill your sales funnel by connecting with potential clients through every possible inbound marketing channel. From implementing localized SEO that highlights your city name, zip code, nearby neighborhood names, and even street names throughout your online content to social media, content marketing, paid internet ads, and beyond, there are all sorts of ways to connect with new prospects who are inclined to convert into paying clients.

If you are not confident in your ability to maximize the potential of the inbound marketing methods listed above, do not hesitate to outsource the work to those who specialize in each unique component of inbound marketing. While some prospects might be partial to social media, others are more inclined to click embedded videos rather than read text. Furthermore, some clients are likely to click ads on search engines after conducting searches relevant to your financial advisory firm. Others are more likely to seriously consider your firm’s value offering and subsequently convert into a paying client after reading a blog post on your site or a guest blog post on another website’s blog. Some people place heightened importance on messages emailed directly to them from financial advisors in their area. This is precisely why it is in your interest to put your metaphorical inbound marketing eggs into several different baskets instead of going all-in on one.

If you are not confident in your ability to maximize the potential of the inbound marketing methods listed above, do not hesitate to outsource the work to those who specialize in each unique component of inbound marketing. While some prospects might be partial to social media, others are more inclined to click embedded videos rather than read text. Furthermore, some clients are likely to click ads on search engines after conducting searches relevant to your financial advisory firm. Others are more likely to seriously consider your firm’s value offering and subsequently convert into a paying client after reading a blog post on your site or a guest blog post on another website’s blog. Some people place heightened importance on messages emailed directly to them from financial advisors in their area. This is precisely why it is in your interest to put your metaphorical inbound marketing eggs into several different baskets instead of going all-in on one.

Embrace the opportunity to connect with new clients through each of these web-based avenues and you will maximize the chances of moving them through your digital sales funnel, ultimately converting them into loyal clients who recommend your financial advisory firm to others who can benefit from your services.

Updated 10/16/2021